I didn’t intend to write this much, but it’s probably the first time I can tell my crypto story properly.

The Mining Era

BlackCoin

Hodl, Trade, Repeat, Hindsight

The Bryce Years & Living on CryptoThe Mining Era

It feels like a lifetime ago when crypto came into my consciousness, but in reality it was November 2013.

I was in my mid-30s, towards the end of a particularly long and increasingly doomed relationship, for which I’m happy to hold my hands up to being at least 50% responsible.

Bitcoin was pumping, and for the first time en route to hitting $1,000 a coin. There was palpable excitement in the media about it. I hadn’t a clue what it even was when I read about it – I remember initially thinking ‘Ponzi scheme!’, as I imagined everyone involved as already having gotten rich, and attempting to drive the rest of us to plough our life savings in. Ironically, looking back, that sounds about right.

Either way I felt the pangs driving me to this dark side for multiple reasons.

In my 20s, I had created an online business that ran itself, by driving website traffic to advertising. Provide a hands-off unique service and/or great content and then it’s a numbers-in (people), numbers-out (money) game. Believe it or not, once the hard work is done, it gets quite samey earning in your sleep, and I had lost my mojo. I was struggling for the next big idea, and my skillset was languishing. Tech moves on really quickly and you have to put extra effort and money in over time to keep up at the rate of change. So even though I was still making a good living from that business, coupled with the feeling of my home life getting similarly out of whack, this all turned up at a good time.

In my time in business, I had several run-ins with banks. The majority of money I earned was in US Dollars and I live in the UK. In those days, the money would arrive in the form of a paper cheque. I had to endure various moments where the bank tried (but failed) to get me to sign assets (like my house) against the risk involved in me depositing said cheques – because behind the scenes they took 6 weeks to clear – even though not a single one ever bounced. I also grew increasingly irritated at the fees and terrible exchange rates applied when said funds went in. One bank I had been with since I was 7 years old one day decided I was ‘outside their risk appetite’ and closed my business account with very little warning. It made me feel like a criminal, even though I was running a perfectly legal and legitimate business. These things made me appreciate the benefits that cryptocurrency brings to the table straight away.

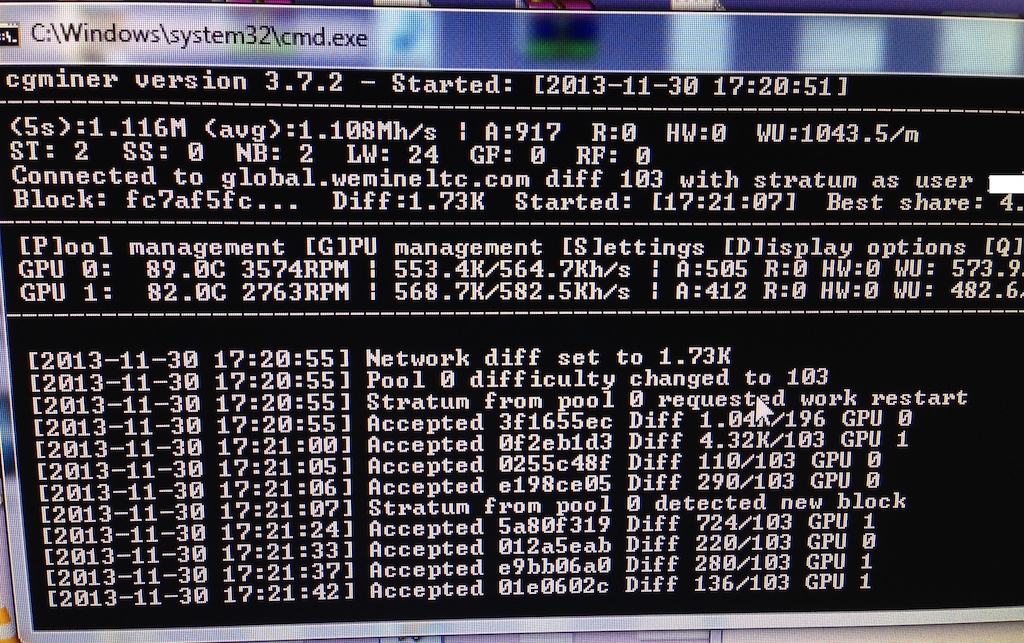

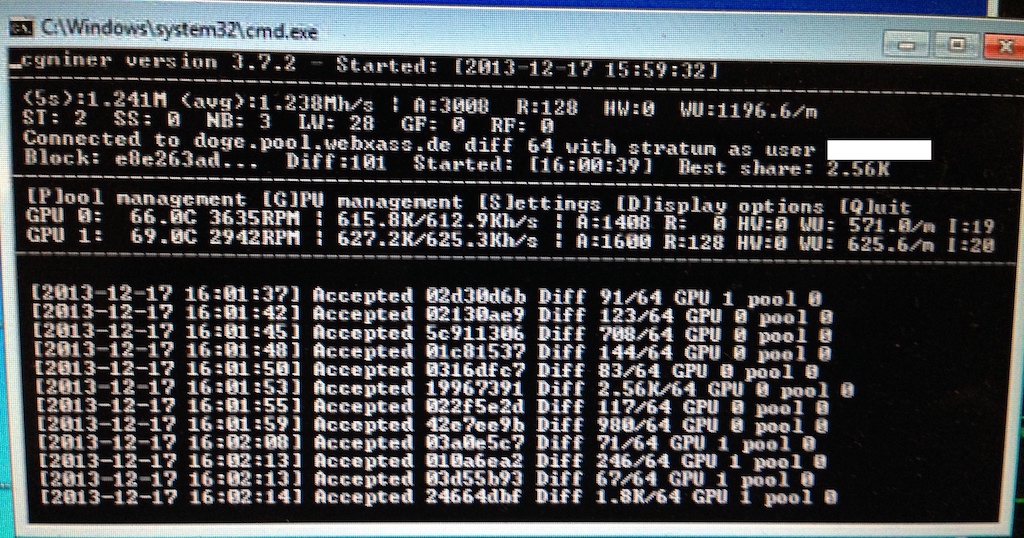

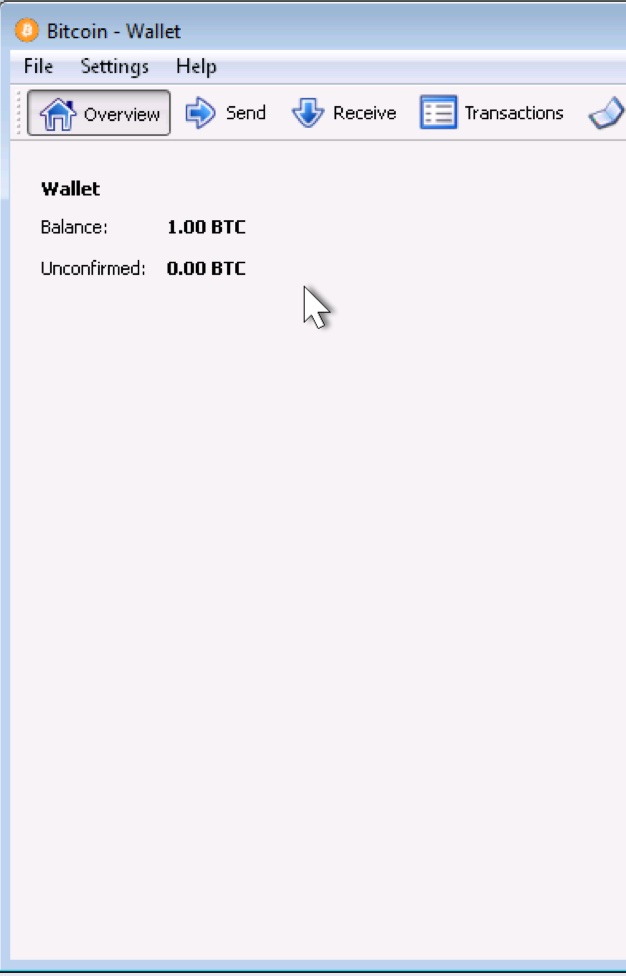

Last but not least, after reading about this newfangled crypto thing, I started dabbling with mining software like CGMiner, using just my PC’s CPU and it really got my nerd juices going! It felt like returning to some bygone era, with everything done in the command line. It also made my computer get very hot and crash a lot! So when a fraction of a coin of magical Internet money appeared in my wallet, it actually did feel magic and catapulted me back to the mid 1990s, the feeling akin to discovering I could publish to the entire world by writing a few HTML tags in Notepad and uploading the file to Geocities.

Autonomy and freedom expressed digitally, but this time with money! It felt new, exciting and liberating – not only was it masquerading as some kind of bizarre ‘get rich quick’ scheme but it made me question the whole notion of money itself. How had I got to the age of 35 and never questioned what money is? And why we are so complicit in its trappings? That then led to a complete rabbit hole involving forums, books and YouTube – well, a lot of Andreas Antonopoulos – and I emerged never quite the same again. People in Bitcoin refer to this as taking the ‘orange pill’ – perhaps for me it was a bit more multicoloured than that.

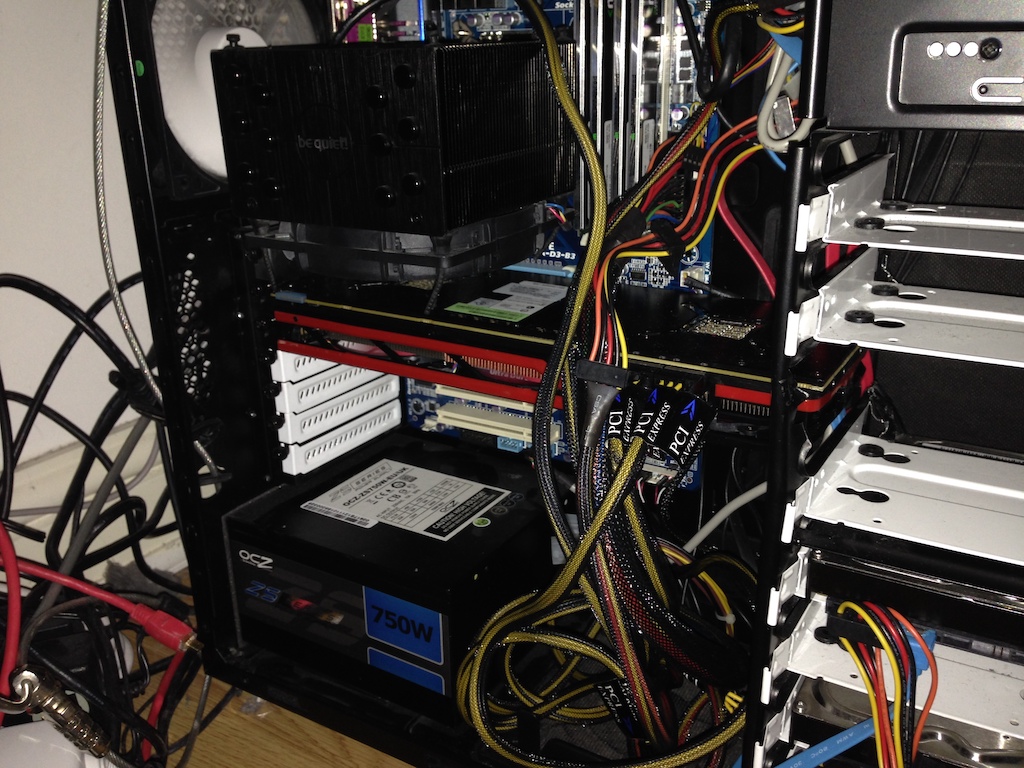

That same month I invested in my first graphics card to mine with: a dual-GPU AMD Radeon HD7990. It was an amazing beast! I had to cut a hole out of my PC’s hard drive chassis to fit it into the case.

I started by mining Litecoin, Feathercoin and then found a favourite in Dogecoin. Bitcoin was way too far gone, difficulty-wise for someone hobbying their way into mining to score big. I didn’t really have the appetite to just speculate on Bitcoin (or any other coins using SHA256 hashing) by using purpose made ASIC miners, instead I liked the idea of being able to mine whatever new thing surfaced, and it turned out to be excellent fun discovering all the different ways to push the cards to their limits and use different hashing algorithms for different coins and so on.

Aside from electricity, the purchases of graphics cards and associated hardware (which I sold at breakeven 6 months later), the only time I have ever put money directly into crypto was when I bought into the XX Network in January 2020 – over 6 years after starting in crypto. Perhaps that tells you how highly I regard the XX project! Also, perhaps it hints at the rather bizarre journey of those 6 years.

Perhaps one day, if I can remember any of it properly, I’ll write a book, but here’s the relatively short version for you.

During the early part of 2014, the Altcoin world exploded with new coin launches happening every single day. I would seek out ones that looked promising, set alarms in some cases and be poised at the moment they went live – which consisted of downloading and running a wallet the coin creator would make live at the launch time then pointing the miners at the RPC port of that wallet to ‘solo mine’ the coin. A good percentage of the time I would score multiple blocks of coins really early on and let it ride until the difficulty got too high to bother continuing and I’d then move onto either mining in a pool for that coin or another coin launch entirely. It was incredibly addictive and fun to build up little balances of lots of strange sounding new currencies.

Of course, these coins were all pretty much worthless. Some of those I mined claimed to be mathematically/economically clever (e.g. Quark, Groestlcoin, 42 Coin, Dirac), some were just animals (e.g. CatCoin, Kittehcoin, HorseCoin, BeeCoin, PandaCoin etc) because of DogeCoin existing, basically, and some turned out to be (or get used for) incredibly elaborate scams, (ZetaCoin, UroCoin, ARCH and so on). I mined dozens more, trying to imagine a future where any of these might rise to a sustained high value.

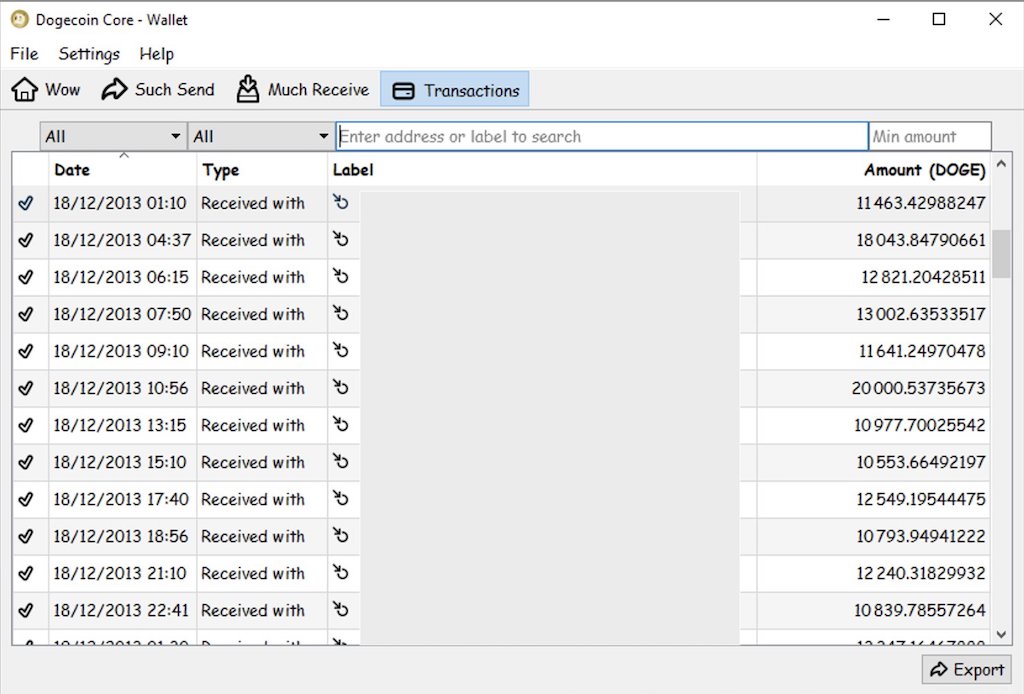

Honestly, I would never have bet on Doge still existing today or being worth anything. There were days in December 2013 where I mined 150,000+ DogeCoin. They were fractions of a penny each back then and cost less in electricity to produce.

Given one day’s results from mining Doge back then would be worth $8k+ now ($90k at peak!), hindsight is a great thing, which is a bit of a theme of this story.

I also have some long-winded tales about what happened in some of these projects having spent time in the communities of ones I particularly liked, (mainly on the bitcointalk forum and generally on Twitter). The drama is, in some cases, inscribed into crypto history – ‘Holy week’ in Zetacoin, and a man with a funny name who sang about trading shitcoins threatening to kill a dev called rat4 when the exchange he worked for screwed up are a couple of cases in point that spring to mind. Not to mention the endless streams of extremely questionable/downright criminal people who seemed to pop up – MintPal V2 for example. The less said about that the better.

Over all, being in crypto during the spring and summer of 2014 released more adrenalin and dopamine into my system than any amount of social media ever would. I was hooked.

In late February 2014 I found a coin which I thought stood a really good chance of doing well – BlackCoin (BC/BLK). I mined the hell out of it as soon as it launched. It proposed a whole new idea for a coin of its type – it would be the first to go ‘full’ Proof of Stake after an initial mining period for coin distribution. It was ‘fair launch’ (the dev – rat4 of above death threat fame – wasn’t getting any pre-mined coins) and everything about it sounded great. It was a real technological novelty in a sea of cloned shitcoins.

2X HD7990 + 2x HD7950 GPUs

To the topBlackCoin

I guess you won’t have heard of BlackCoin, but trust me, in 2014 most people in crypto definitely had because of the fact it went from 200 Satoshi (0.00000200 BTC) to 90,000 Satoshi (0.00090000 BTC) per coin (450x) in a matter of 6 weeks, peaking in April. This was before stablecoins, so there were no USD trading pairs to speak of back then (unless trading actual fiat). We’d all be doing double sums to figure out how much our coin was actually worth with our BTC pairs. Much more fun!

Enormous pumps in altcoins like this were unheard of too, this was pretty much the first one to happen the way it did. It was also my first exposure to the feeling of “Oh wow, this might actually work out!”, with my BlackCoin stash having cost me pennies in mining to suddenly being worth almost 500 BTC at peak. BTC was about $500 each then. I guess you can ‘do the math’ as they say.

It was a different era before many people were vocal about how much they were making in this weird new world, so the feeling for me of potentially sitting on a couple of hundred grand truly was magic, given I’d spent barely anything to get there. And it felt like the only way was up. The one thing I thought I knew, given (and I know this is somewhat of a meme now) the ‘new paradigm’ of things like Proof of Stake was that Bitcoin was done! Who’d want to hold that antiquated shit?

Like I say, hindsight is a wonderful thing.

I know I’m not alone in watching the BlackCoin pump and its subsequent dump all the way, whilst holding all the BLK I had mined. By the time it settled in the 20,000-30,000 Satoshi range in the summer of 2014, I was pretty convinced it was just a correction and we’d see a second wave. Sadly, it never traded that high against Bitcoin ever again.

BTC market pairs were far more exciting because of it being two volatile assets swinging against each other and not just one against a dull (and potentially dodgy) stablecoin like Tether. Imagine if I’d just sold my BlackCoin at the top and held the 500 BTC? That $250k would be $35m+ in today’s price. I didn’t though, obviously, that would have been boring. Instead I caught the trading bug and spread myself thin for a while.

It was also in this era that I gave four of my friends and relatives individual Bitcoins as gifts – they still hold them to this day. They were worth $400ish at the time. Hello hindsight! Nice to see you again!

I can only really recall the highlights of my relatively brief spells of on-off trading, and at each step, BlackCoin was my float for the initial buy-in. If I did well in another coin, I would always buy some BLK back. It was my stablecoin. Except all it did was go down! You have to remember that at this point I was still only dealing in the hundreds to very low thousands of dollars worth of crypto a year, even with buyins of a few BTC. Things were a lot cheaper back then!

As it had all been conjured up from nowhere, it felt like it could go back to nowhere and I wouldn’t feel too bad about it.

I look back on why I stuck with BlackCoin for so long and it’s because I liked the attitude of the dev (rat4) from the outset. He wanted his crypto to work. He didn’t get rich from it, and quite the opposite in terms of his mental health. In 2018 he severed his ties with the project and invited people to burn their BlackCoin (send them to an unspendable address) in exchange for coins in his new project, BlackNet. Again, a really nice idea in terms not just airdropping folks so that BlackNet started with some perceived value. Plus, it was a completely unique blockchain project that rat4 built in Kotlin (a Java-like programming language) from scratch. I split my stash 50/50 BlackCoin to BlackNet, and BlackNet is one of the very few coins I still have some of to this day other than XX. Rat4 is still actively developing it, and it’s basically worthless. I really admire that.

During the remainder of 2014 and really all the way to 2017, I would put a few BTC derived from little sells of BLK into newly announced projects. Occasionally I would get carried away and sometimes it paid off. I wasn’t afraid to be classed as a ‘classic shitcoiner’ along the way. It was still the Wild West for the most part and much more fun than being a Bitcoin maximalist.

To the TopHodl, Trade, Repeat, Hindsight.

What ultimately happened from here is a tale of woe with perhaps a single good outcome.

I watched the Ethereum initial sale happen in 2014 without buying any. The process to get involved seemed incredibly opaque and the price seemed astronomical from the outside (2,000 ETH per Bitcoin). It honestly seemed scammy. And so I didn’t put the usual 5 BTC anywhere near it. Yes, I am aware how much 10,000ETH is worth nowadays.

Instead I continued to focus on things that seemed ‘real world’ and had a ‘use case’. This has always been my problem with crypto trading – I really wanted crypto to work! In the real world!

So to that end – one particularly bad shitcoin that sits firmly in my mind is URO. This was quite the ride. It set out with a supposed vision to help rural farmers with the cost and friction of trading urea (the fertiliser) and essentially stated from the outset that 1 URO coin would be exchangeable (by them and their wholesale partners) for one metric tonne of the stuff. Sort of like a predecessor to a stablecoin but for a chemical found in our liquid excretions. This obviously led to jokes about it being the ‘pisscoin’. It was amazingly far fetched but the team made pains to try and prove their legitimacy, and the sweet spot culminating in some kind of proof of a shipment of 25,000 tonnes of the stuff having been bought in URO (allegedly). A long story with lots of holes and it seemed incredulous to believe at all, but there was background trading, and I quietly accumulated URO on the side thinking it had to pump at some point. The downside for me was when the coin did pump, it was incredibly short and sharp and I was (begrudgingly) out with my then partner (of doom) and missed the top! My stash was worth 300BTC at peak, but I got out when it started frantically dumping the next day for around 50. It was actually my best haul that I actually realised from a single coin in terms of BTC, bearing in mind though that BTC was still only worth a few hundred dollars at the time.

Most of that haul was whittled away with ICO projects that went nowhere and a particularly bad decision to have a go at futures trading on OKCoin where I lost 20 of it on Christmas Day 2016(!). I still had some trusty BlackCoin and I still had a little bit of Bitcoin to put into new things.

In 2017 I made a worse mistake than not selling all my BLK in April 2014 or buying into the Ethereum sale. At the time, in June, two Initial Coin Offerings for new exchanges were going on and I was choosing which seemed the best proposition to throw 5 BTC into. Obviously I couldn’t just put a bit into each, that’d be no fun(!).

Utilising a government initiative for businesses called eResidency in Estonia, Mothership (MSP) wanted to become the most trusted exchange, and it garnered interest from the biggest crypto influencers of the time (CryptoCobain and Jebus911 for example). The memes in the telegram were endless and there was tremendous buzz about it. It was a no brainer. The other ICO, I chose not to take part in, was for an unknown Chinese entity calling itself Binance, who seemed to throw the idea of regulation away with clear abandon. So I of course chose the most likely one to win! 5 BTC worth of BNB at crowd sale was worth $57m at BNB’s peak of $686. Mothership dwindled with endless development updates to no avail and eventual point of delisting (especially after the only exchange it was listed on got hacked). All but one of the team completely abandoned it. It’s now associated with a startup which issues crypto collateral backed fiat loans called Dascue, with no sign of how the MSP token will ever feature in that business. I still hold my MSP.

To the topThe Bryce Years and Living on Crypto

There is a light at the end of this tunnel of doom and it starts and ends with a divisive character called Bryce Weiner. Bryce was well known in shitcoin circles, and even proclaimed himself the shitcoin God, boasting that he had created more coins in the altcoin boom than anyone else. A dubious thing to scream about, given all of them came to nothing.

He had a likeable side though, through all his bluster, because he spoke his mind at the very least. Often confrontational and quite often seemingly delusional, in 2016 he started talking about a project in the music industry and it piqued my interest as it had an air of actual legitimacy. There were real world executives involved, a studio owner and a connection to musicians people had actually heard of. One guy had written Madonna songs in the 1980s, another was pally with members of the Hendrix family and one was the brother of the late Old Dirty Bastard from the Wu-Tang-Clan.

The coin was called Tao, and it was to be Bryce’s crypto career pinnacle – the real deal. The plan eventually evolved as thus – start an exchange whereby musicians’ careers were tokenised. The artists gained from the initial sales of the tokens, and in return provided benefits to the holders (VIP events, discounts, merch etc). If they did well in their careers, their tokens would go up because people would buy them like stocks and they’d win again (having been given an allocation at the outset). And everyone else would have immense fun and get rich trading all these famous people, obvs.

How close all this flew to the rules around securities at the time was actually addressed up front which was bizarrely progressive for an unknown crypto. Bryce met and had photos with members of congress and the CFTC (I’m not sure about the SEC!) talking crypto behind closed doors, and even published a letter of opinion from his (legitimate) lawyers about Tao not being a security. This was years before regulators started throwing their weight around. It seemed like full-steam ahead for the project.

Having ploughed my usual 5BTC into this as a punt from the outset in 2016, it actually started to seem like it could lead somewhere.

Everything was a bit of a struggle for one reason or another, as often was the case in these burgeoning projects trying to do all things at once. The exchange did actually launch (it was called Alt Market), and the first IAO (Initial Artist Offering) occurred with ODBCoin (fronted by Young Dirty Bastard) being bought and traded in late 2018. It took two years, and despite the seeming eventual falling out of everyone involved, including the artist, it happened.

Cracks started to show pretty soon after, the exchange went offline (allegedly held to ransom by the developers) and the project fizzled out, slowly, after transitioning to an EVM style coin fork of TomoChain in a bid to rekindle interest.

For me, however, I took the chance to part with some Tao on the way up. Perhaps I’d finally learned from my mistakes, but I found an OTC buyer who snapped up about 20% of my Tao holdings for 40BTC in August 2018.

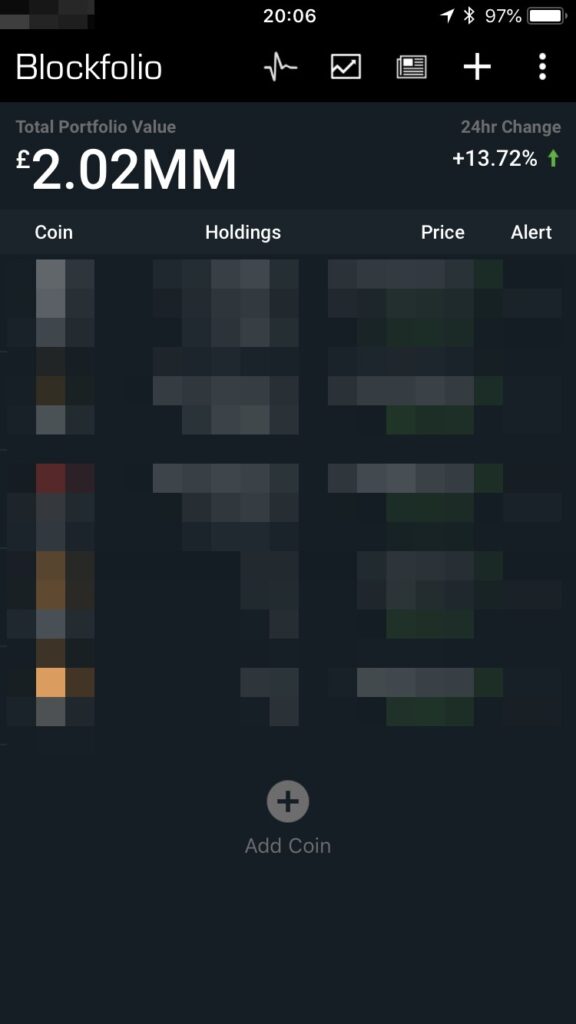

At that time in late 2018, life looked rosy. My ‘Blockfolio’ balance (an app later acquired by the defunct FTX) was showing 7 figures, and for the first time ever, I actually took fiat money out of the crypto economy. The 40BTC from Tao was exchanged OTC in late 2018 through an FCA registered exchange in the UK. (Bitcoin was trading at around $7k a coin at the time). This was done after I produced a 150 page KYC/AML document detailing my entire life in crypto up to that point, as it was the first time I took any money out. The money went into the bank without issue and I paid all the appropriate taxes. I’m surprised by the lack of drama to this day – I fully expected another bank account closure.

Of course, that wouldn’t be a fun end to this tale.

Firstly, of course we all know BTC eventually pumped to all time highs of $120k+ in 2025, so I could have been a millionaire in theory yet again if I had just held it. But, in the end, getting so deep into this world meant my other business wasn’t doing so well, and I needed to live on the proceeds. And that I did. To be fair I managed to make it last almost five years, including throughout the whole sorry COVID era.

As for Tao – my remaining 80% exists on a ledger somewhere, but the network is dead.

And, as for my precious BlackCoin – symbolically I traded out the very last of it and combined it with some of my fiat savings to help me buy in the initial XX Coin sale, in January 2020. New beginnings were afoot.

And that’s where I’ll let the story continue in the XX Network Introduction.

To the top